Policy Watch

PM Narendra Modi Launches New Digital Payment Solution: What is e-RUPI And How It Works

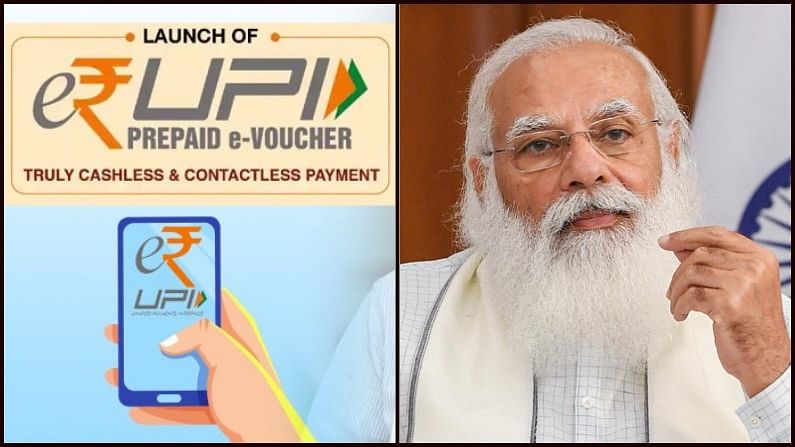

NEW DELHI: Prime Minister Narendra Modi unveiled e-RUPI, a cashless and contactless digital payment instrument. The one-time payment mechanism aims to eliminate leakages in government welfare programmes and ensure that benefits reach the intended recipients.

Benefits cannot be misused because they are delivered to beneficiaries’ mobile phones in the form of a QR code or SMS. e-RUPI does not require any physical interface for transactions to make the system more user-friendly. Because it is prepaid, it is regarded as secure.

The National Payments Corporation of India created the instrument on its UPI platform in collaboration with the Department of Financial Services, the Ministry of Health and Family Welfare, and the National Health Authority.

What Is e-RUPI And How Does It Work?

e-RUPI is a QR code or SMS string-based e-Voucher, which is delivered to the mobile of the beneficiaries. The users of this seamless one-time payment mechanism will be able to redeem the voucher without a card, digital payments app or Internet banking access, at the service provider.

It connects service sponsors with beneficiaries and service providers in a digital manner with no physical interface. It also ensures that payment is made to the service provider only after the transaction is completed.

Because it is pre-paid, it ensures timely payment to the service provider without the involvement of a third party.

e-RUPI is expected to be a revolutionary initiative for ensuring the delivery of welfare services is leak-proof.

It can also be used to deliver services under schemes that provide drugs and nutritional support under Mother and Child Welfare schemes, tuberculosis eradication programmes, drugs and diagnostics under Ayushman Bharat, Pradhan Mantri Jan Arogya Yojana, and fertiliser subsidies.

These digital vouchers can also be used by the private sector as part of employee welfare and corporate social responsibility programmes.

How is e-RUPI different from other digital payment apps?

The most significant distinction between e-RUPI and other online payment apps is that e-RUPI is neither a platform nor an app. It is a voucher that can only be used for specific services. Unlike other payment services, this voucher does not require the user to have a digital payment app or even a bank account to be redeemed.

What are the benefits of using e-RUPI?

It is advantageous for corporations because it is an end-to-end digital transaction that does not require physical issuance. As a result, the organization’s costs will be reduced. Furthermore, the issuer will be able to track voucher redemption.

e-RUPI will be beneficial to users because it is “easy and secure.” Because it has a pre-blocked amount, the chances of a transaction being declined are greatly reduced. According to NPCI, it has a two-step redemption process, and the user is not required to share any personal information when redeeming the voucher. It is worth noting that consumers do not need to have a digital payment app to redeem the voucher.