Economic Fraud

Know How Much Money These Top 50 Wilful Defaulters In India Owe To Banks

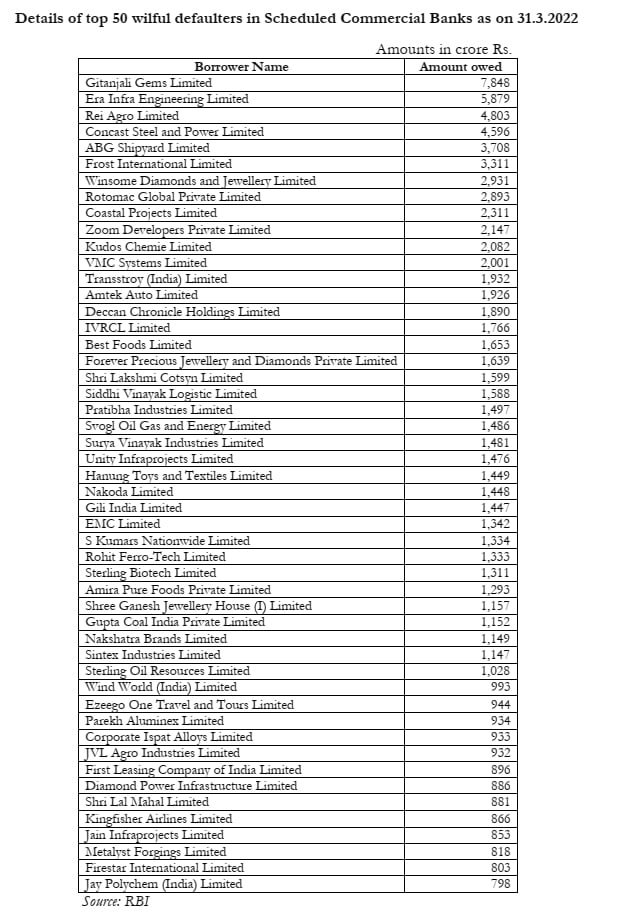

NEW DELHI: The top 50 “wilful defaulters” in the country owed Indian banks Rs 92,570 crore as of March 31, 2022, the government said in Parliament on December 19, citing Reserve Bank of India (RBI) data. Wilful defaulters are borrowers who have the means to repay the banks but refuse to do so. Banks exclude such defaulters from the financial system, and these borrowers cannot obtain loans or start new firms.

Minister of state Bhagwat Karad told Parliament in a written statement that Gitanjali Gems Limited, which defaulted on loans of Rs 7,848 crore, is at the top of the list. Following it are Era Infra (with a Rs 5,879 crore exposure) and Rei Agro, which defaulted on debts worth Rs 4,803 crore.

Mehul Choksi, the fugitive diamantaire, promotes Gitanjali Gems. The CBI filed three additional cases against Choksi last week for allegedly defrauding a group of banks of Rs 6,746 crore. According to sources, Choksi, Gitanjali Gems, and its senior officials are accused of defrauding a consortium of 28 banks of Rs 5,564 crore between 2010 and 2018.

Concast Steel and Power, ABG Shipyard, Frost International, and Winsome Diamonds and Jewellery are all on the list, according to the ministry.

What happens to deliberate defaulters?

According to the RBI, wilful defaulters are not granted any additional facilities by banks or financial institutions, and their unit is forbidden from launching new initiatives for a period of five years.

Through the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2016, wilful defaulters and companies with wilful defaulters as promoters or directors are forbidden from accessing capital markets to raise cash.

According to RBI data, total non-performing assets (NPAs) of public sector banks (PSBs) peaked at Rs 8.9 lakh crore following the central bank’s Asset Quality Review and have since dropped to around Rs 5.41 lakh crore as of March 31, 2022.

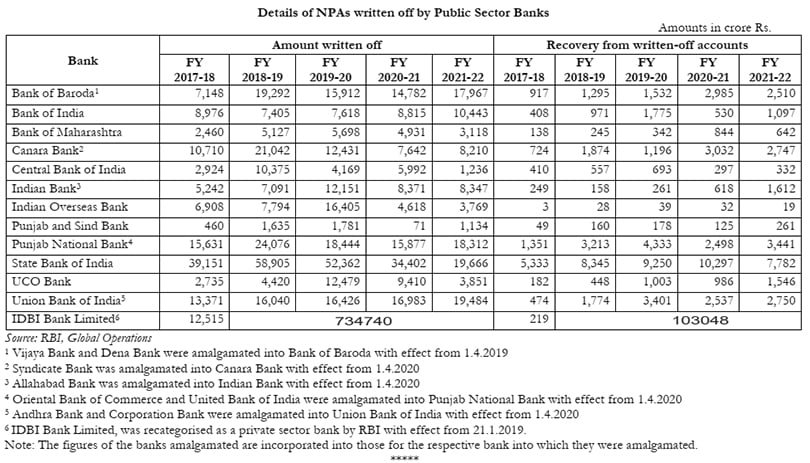

Banks attempt to collect poor loans, but lenders often write off loans when recovery is impossible. According to RBI statistics, banks have written off Rs 10.09 lakh crore in the last five fiscal years.

State Bank of India (SBI) wrote down Rs 2 lakh crore in the last five fiscal years, followed by Punjab National Bank (Rs 67,214 crore) and IDBI Bank (Rs 45,650 crore).

ICICI Bank wrote off Rs 50,514 crore in liabilities, while HDFC Bank wrote off Rs 34,782 crore in loans.

Over the years, write-offs have contributed significantly to the fall in bank NPAs. The gross NPA ratio of banks decreased to a six-year low of 5.9 percent in March 2022, according to the RBI’s financial stability report for June 2022. In March 2022, the net non-performing assets ratio declined to 1.7 percent.

The gross NPA ratio is the percentage of problematic loans in a bank’s total loans.

Follow The420.in on

Telegram | Facebook | Twitter | LinkedIn | Instagram | YouTube