Trending

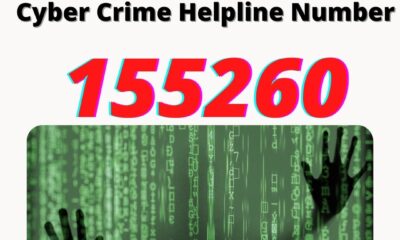

Victim Of A Cyber Attack? Now Dial 1930 & 155260 To Register Complaint And Get Your Money Back

NEW DELHI: Addressing the issues of increasing cases of cybercrime, the Ministry of Home Affairs (MHA) has released a helpline number – 1930 & 155260 for the public to register their grievances and help them in getting their lost money back.

So, if you are a victim of cybercrime, you may now report it by dialing 1930 & 155260. This latest helpline number, like 112 — previously 100 — will act as an emergency number for those in Delhi who are being targeted by cybercriminals.

According to officials, the Indian Cybercrime Coordination Centre (I4C) and the Union Home Ministry launched an initiative to establish and make available to state police forces a Citizen Financial Fraud Reporting and Management System. The country has seen a huge spike in cybercrime cases. Several people during the pandemic reported SIM card cloning and fraudulent transactions involving money being withdrawn from their accounts and transferred to other payment wallets.

According to the officials, it was in November 2020, the cybercrime cell of Delhi police along with the help of the MHA, decided to revamp the helpline, enhancing its capacities on a pilot basis. The police added 10 more lines to the helpline and have already seen success, helping 23 victims recover from the financial fraud either partially or fully.

ALSO READ: Step By Step Guide: How To File Cybercrime Complaint Online In India

Anyesh Roy, the deputy commissioner of police (cyber cell) said that so far the 23 victims have been able to get back Rs 8.11 lakh back out of which the biggest beneficiary was a retired account officer based out of Delhi, who managed to get back Rs 98,000 which he lost to a fraudster.

In such financial frauds, Roy believes that catching the fraudster lies in how soon the complaint is lodged and attended, which is why this helpline will play a crucial role. The police have also joined hands with about 50 banks and online payment platforms.

How the helpline works:

1: Victim dials helpline, manned by a police officer.

2: If the crime took place more than 24 hours ago, the person is asked to formally lodge complaint with the portal.

- If the fraud took place within the last 24 hours, the operator fills up a form after seeking personal information and details of the purported crime

- A ticket then gets escalated to the financial intermediaries (FI) concerned.

3: The fraud transaction ticket is shown on a dashboard of both the debited Fl (i.e. bank where the victim has an account) and the credited FI (the bank/wallet of the fraudulent beneficiary account)

4: The bank/ wallet to which the ticket has been escalated checks for the details of the fraud transaction. If the funds have moved out, it feeds the transaction details in the portal and escalates it to the next Fl. If funds are found available, It temporarily puts them on hold.

5: The escalation of the ticket continues till the funds are either put on hold or they have exited the digital ecosystem, either through an ATM withdrawal, physical withdrawal, utility payments, etc

Explaining the steps involved a senior official said when a victim first falls prey to the scam, they call up the helpline within 24 hours with the details of their bank account or e-wallet from which the money had been deducted and if possible the bank account of where the money had been deposited.

“With this information, the police immediately inform the bank or the e-wallet service provider of the fraud. This information reaches the employees on their phones and emails. If the money hasn’t been withdrawn from an ATM or been used to make a payment, the money gets put on hold by the bank or e-wallet service provider on behalf of the police’s request. The money, later on, gets returned to the victim,” the official said.

The victim also needs to personally call their banks or e-wallet service providers to prevent further deductions but calling the helpline number helps in increasing the chances of retrieving the money. The entire system depends on how quickly the financial scam is reported. The earlier it is reported, the better.

This heavily differs from the traditional way of going to a police station to report a crime, in the sense that it takes a few hours for the complaint to be registered with the police station or even cybercrime cell and for the police officers to begin their investigation. Calling the helpline on the other hand, helps begin the retrieval process immediately.

This national platform was formally announced on April 1. Rajasthan has already joined this national platform, and other states are expected to join soon!

Prakash Singh, the former DGP of Uttar Pradesh said that this platform was an excellent initiative and that even if it helps bring back the money of a fraction of the victims, it would have helped. At the end of the day, most victims just want their money back and that is exactly what this platform promises to do.